rhode island tax table 2020

2020 Rhode Island Tax Expenditures Report. Ad Download Or Email RI-1040NR More Fillable Forms Register and Subscribe Now.

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

How Income Taxes Are Calculated.

. The following table shows the. Includes All Towns including Providence Warwick and Westerly. Employees must require employees submit state Form.

Comprehensive Reporting for Accurate Planning and Compliance. Comprehensive Reporting for Accurate Planning and Compliance. Tax rate of 375 on the first 68200 of taxable income.

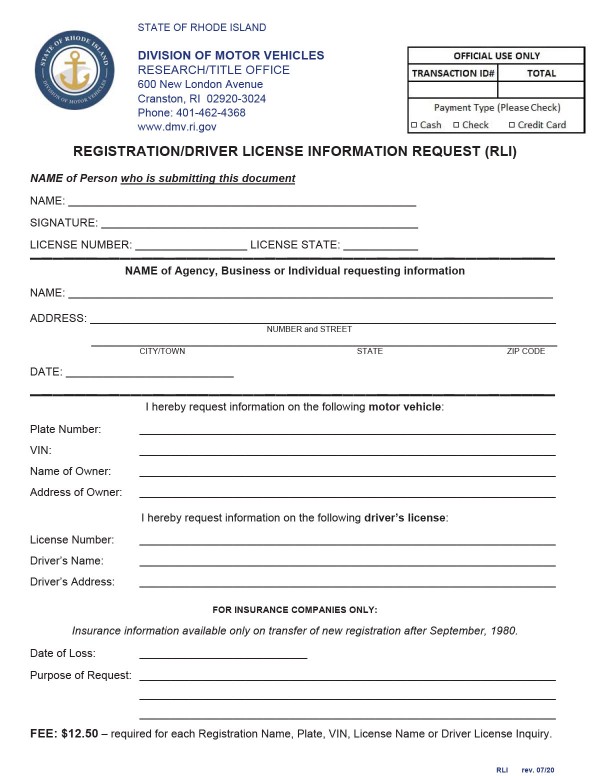

The Rhode Island Division of Taxation has released the state income tax withholding tables for tax year 2020. How to Calculate 2020 Rhode Island State Income Tax by Using State Income Tax Table 1. The annualized wage threshold where.

Tax rate of 475 on taxable income between 68201 and 155050. Download or print the 2021 Rhode Island Tax Tables Income Tax Tables for FREE from the Rhode Island Division of Taxation. 2022 Rhode Island Sales Tax Table.

This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020. Rhode Island Tax Brackets for Tax Year 2020 Tax Rate Income Range Taxes Due 375 0 to 65250 375 of Income 475 65250 to 148350 244688 475 599 148350. The annualized wage threshold where.

Ad Download Or Email RI-1040NR More Fillable Forms Register and Subscribe Now. The chart below breaks down the Rhode Island tax brackets using this model. Some Rhode Island tax-related amounts for 2020 including income tax bracket thresholds and the standard deduction were released Nov.

The income tax withholding for the State of Rhode Island includes the following changes. Tax rate of 599 on taxable income over. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

Rhode Islands income tax brackets were last changed. Find your pretax deductions including 401K flexible. Pay Period 15 2020.

Ad Get Your Copy of Bloomberg Taxs 2023 Projected US Tax Rates Special Report. TAX RATES APPLICABLE TO ALL FILING STATUS TYPES 475 599 c Multiply a by b d Subtraction amount 000 66200 252882 RHODE ISLAND TAX COMPUTATION. This form is for income earned in tax year 2021 with tax returns due in April 2022.

We last updated Rhode Island Tax Tables in January 2022 from the Rhode Island Division of Taxation. More about the Rhode Island Tax Tables Individual Income Tax TY 2021 We last updated the Income Tax Tables in January 2022 so this is the latest version of Tax Tables fully updated. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the.

Single Tax Brackets Married Filing Jointly Tax Brackets For earnings between 000 and 6525000. The income tax withholding for the State of Rhode Island includes the following changes. Ad Download Or Email RI-1040NR More Fillable Forms Register and Subscribe Now.

Find your income exemptions 2. Ad Get Your Copy of Bloomberg Taxs 2023 Projected US Tax Rates Special Report. Tax expenditures are legal mandates that provide preferential tax treatment to taxpayers.

Rhode Island Income Tax Forms. 2020 Rhode Island Property Tax Rates on a Map - Compare Lowest and Highest RI Property Taxes Easily. Pay Period 15 2020.

Rhode Island Estate Tax Everything You Need To Know Smartasset

Where S My Refund Rhode Island H R Block

Estate Tax Ri Division Of Taxation

Rhode Island Income Tax Calculator Smartasset

Rhode Island S Funding Formula After Ten Years Education Finance In The Ocean State Rhode Island Public Expenditure Council

Rhode Island Income Tax Calculator Smartasset

Rhode Island Income Tax Brackets 2020

Historical Rhode Island Tax Policy Information Ballotpedia

Rhode Island Income Tax Calculator Smartasset

Rhode Island Landlord Tenant Laws Updated 2020 Payrent

Rhode Island Sales Tax Guide And Calculator 2022 Taxjar

All About Bills Of Sale In Rhode Island Facts You Need In 2020

Rhode Island Tax Credits Ri Department Of Labor Training